Securing your financial future after the loss of a spouse is a journey that requires navigating through a complex array of survivor benefits. It’s a path marked by paperwork and policies, yet it’s also a passage that can lead to financial stability and independence. As you step into the role of both beneficiary and steward of your financial resources, understanding and accessing survivor benefits becomes a paramount concern.

Social Security Survivor Benefits Social Security survivor benefits provide a monthly income for those who have lost a spouse. The amount you are entitled to depends on several factors, including your age, your health, and whether you have dependent children. If you are of retirement age, these benefits can replace a substantial portion of your spouse’s income. Younger widows, especially those with disabilities or caring for minor children, can access these benefits earlier, providing much-needed financial support.

The application process for Social Security benefits can be complex. It involves understanding how your benefits will be calculated, knowing when to apply to maximize your benefits, and ensuring that all the necessary documentation is in order. To navigate this process, it’s advisable to schedule an appointment with the SSA as soon as possible after your spouse’s passing. They will guide you through the process and help you understand the benefits you’re entitled to.

Life Insurance Proceeds

Life insurance is a critical component of post-widowhood financial planning. When a spouse passes away, the surviving partner must contact the life insurance company to initiate the claim process. Deciding on the method of payout — whether as a lump sum, annuity, or other option — is a crucial decision that will affect your financial future. The right choice depends on your current financial situation, your future needs, and your tax implications.

It’s essential to be thorough when reviewing all potential life insurance policies. Sometimes policies may be through employers, credit unions, or other organizations. Overlooking these can mean missing out on significant financial resources.

Pension and Retirement Plan Benefits

For those who have lost a spouse with a pension or retirement plan, understanding your entitlements can be overwhelming. Different plans have different rules regarding survivor benefits. Some may offer a continuation of the pension payments, while others may provide a beneficiary lump sum. It’s important to get in touch with the plan administrator to understand your options and to make informed decisions about your future.

When considering your options, think about your long-term financial needs. How will the choice you make now affect your financial security in the future? It may be beneficial to consult a financial advisor to help weigh the benefits and implications of each option.

Navigating the Process

The process of claiming survivor benefits often involves a significant amount of paperwork and bureaucracy. Keeping detailed records of your interactions with various agencies and companies can help if you run into any issues. Document conversations, keep copies of all correspondence, and maintain a file of all pertinent documents. This level of organization can be a lifeline if you encounter discrepancies or delays.

Continued Financial Support

Some benefits continue to provide financial support well into the future. Annuities from retirement accounts, government or private pension survivor benefits, and income from investment properties can all contribute to your financial well-being. It’s crucial to assess the reliability of these income streams and consider how they can be incorporated into your financial plan.

Looking Ahead

Once you have a stable base of survivor benefits, it’s time to look to the future. This means reassessing your retirement plans, considering new savings or investment strategies, and understanding how your financial needs may evolve over time. It’s also a good time to revisit your estate plan to ensure that it reflects your current situation and that your assets will be distributed according to your wishes.

Expanding Your Financial Education

Knowledge is power, especially when it comes to finances. Take advantage of workshops, seminars, and other educational resources offered by community centers, financial institutions, and non-profit organizations. The more you know, the better equipped you’ll be to make smart financial decisions.

Emotional and Financial Support Networks

The emotional toll of widowhood cannot be overstated, and it’s important to seek out support networks that can provide guidance and companionship. Whether it’s a local support group for widows or a circle of friends and family, having people to lean on can make all the difference.

Next Steps

Widowhood is undoubtedly a challenging time, but it is also a period of growth and adaptation. By taking control of your financial future through a thorough understanding of survivor benefits, you can create a stable and secure life for yourself. This isn’t just about managing finances; it’s about building a legacy and honoring the life you shared with your spouse. With informed steps and the right support, you can navigate this chapter with confidence, ensuring your financial well-being for years to come.

By harnessing the resources available and seeking out knowledge and support, you can transition from uncertainty to a position of strength. The journey through widowhood can be one of transformation, where securing your financial future is not just a possibility but a reality.

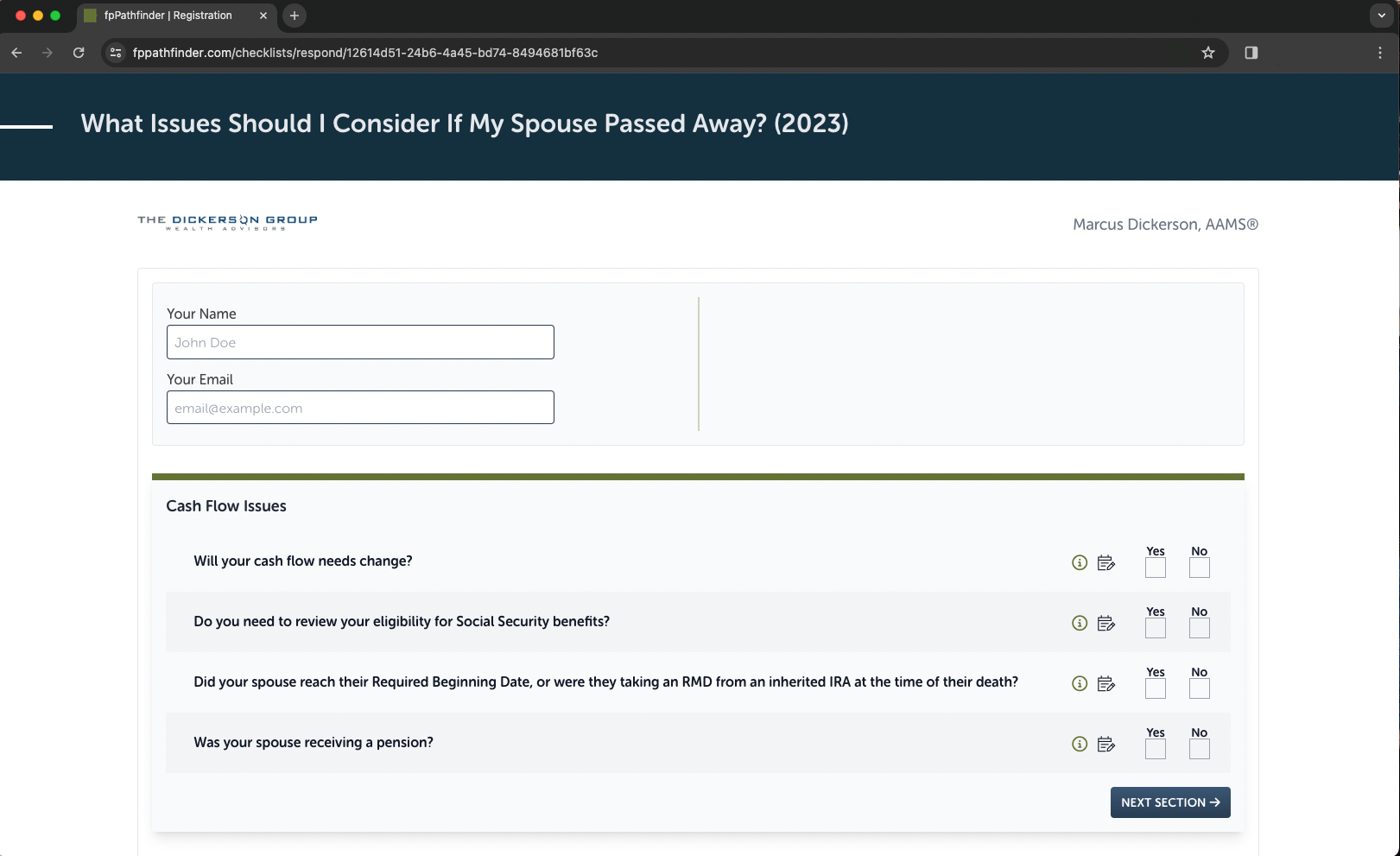

Take a moment to explore our helpful interactive checklist that covers 29 of the most important planning issues to identify and consider when a spouse has recently passed away. It helps identify important planning issues such as Estate Settlement and Tax Issues. We invite you to contact our office to visit about this, or any financial matter you may be considering! Contact our team today!